Homeowner Support

Property Tax Protesting, Homestead Exemptions and Transfer On Death Deeds (TODDS)

Property Tax Protesting

We can represent you by protesting your property tax value on your behalf or teach you on how to best represent yourself.

Property Tax Debt Relief Program Coming Soon!

Property Tax Help for Seniors in Bexar County

We’re developing a new Property Tax Debt Relief Program to help low-income seniors stay in their homes by covering the down payment needed to start a payment plan.

You may qualify if you:

- Live in Bexar County with a homestead exemption

- Have an active tax judgment

- Are 65 or older

- Live on the South or West Side

- Can afford monthly payments (but not the upfront cost)

No repayment required — this is to prevent home loss, not create more debt.

Interested or know someone who qualifies?

Learn how homestead exemptions can reduce your property taxes and

how a Transfer on Death Deed can ensure your home is passed on to your heirs.

Explore the steps below!

Transfer On Death Deed (TODD)

We are not lawyers, please seek the legal advice of an attorney before making a transfer on death deed.

What is a Transfer On Death Deed?

You may want to use a transfer on death when you own real estate, such as a house or land, and you want to give that property to someone else when you die. It does not involve going through probate court, which is what happens when you have a “will,” which can be a long and expensive process.

A transfer on death deed does not affect any of your property rights during your lifetime. It only takes effect after its death.

– The designated beneficiary has no legal right to the property until death.

– A deed of transfer on death trumps a will.

A transfer by death deed does not protect the property from the claims of creditors.

For a Legal Consultation

Rudy M. Vasquez

Attorney

Need to Sell Your Home?

Don’t let a predatory investor buy your home for less than it’s worth!

Our real estate agents can help you get a fair and reasonable price for your home. Find Real Estate Agents on our homepage!

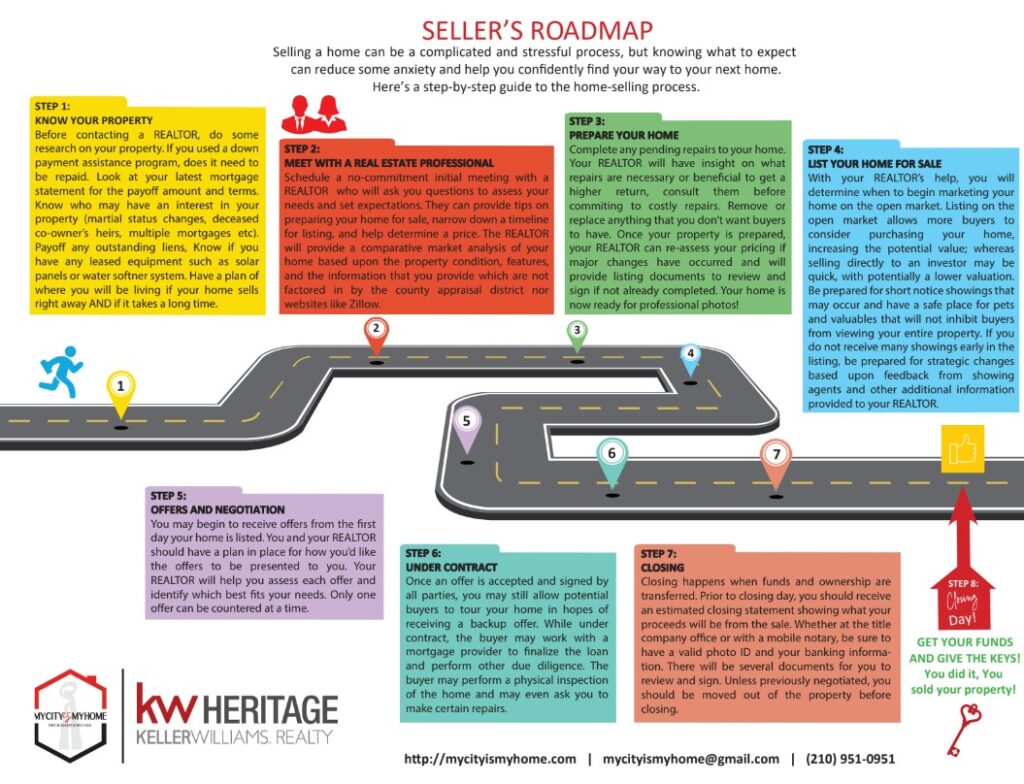

Check out the Seller’s Roadmap below to get started.